Download our latest whitepaper: “Rewriting the Lifecycle Marketing Playbook with AI Decisioning” to learn how industry leaders are leveraging AI agents to drive core use cases like cross-sells, winbacks, and repeat purchases.

Fintech marketers operate in one of the most complex personalization environments. Users can switch to competitors easily, differentiating products is hard to do, and users often manage 3-4 different apps simultaneously. And the stakes are high. Marketers aren’t just nudging someone to use a coupon; they’re helping people manage one of the most important aspects of their lives — their finances.

That means the need for true personalization has never been higher—so Sam who’s retiring, Jill who just bought a house, and Amanda who’s saving for her two kids’ colleges, all receive the right experiences for their needs. And while banks and financial institutions have never been more data-rich, leveraging that data to drive true 1:1 personalization for millions of users across channels was extremely difficult for marketing teams—at least, that was the case until recently.

In this blog post, we’ll explore how AI Decisioning is quickly reshaping personalization at scale, using AI agents to drive more revenue through the marketing activities teams already engage in. Whether it’s cross-sells, winbacks, or product adoption — we’ll show how teams reach millions of customers, at scale, across every marketing channel.

The fintech personalization ceiling

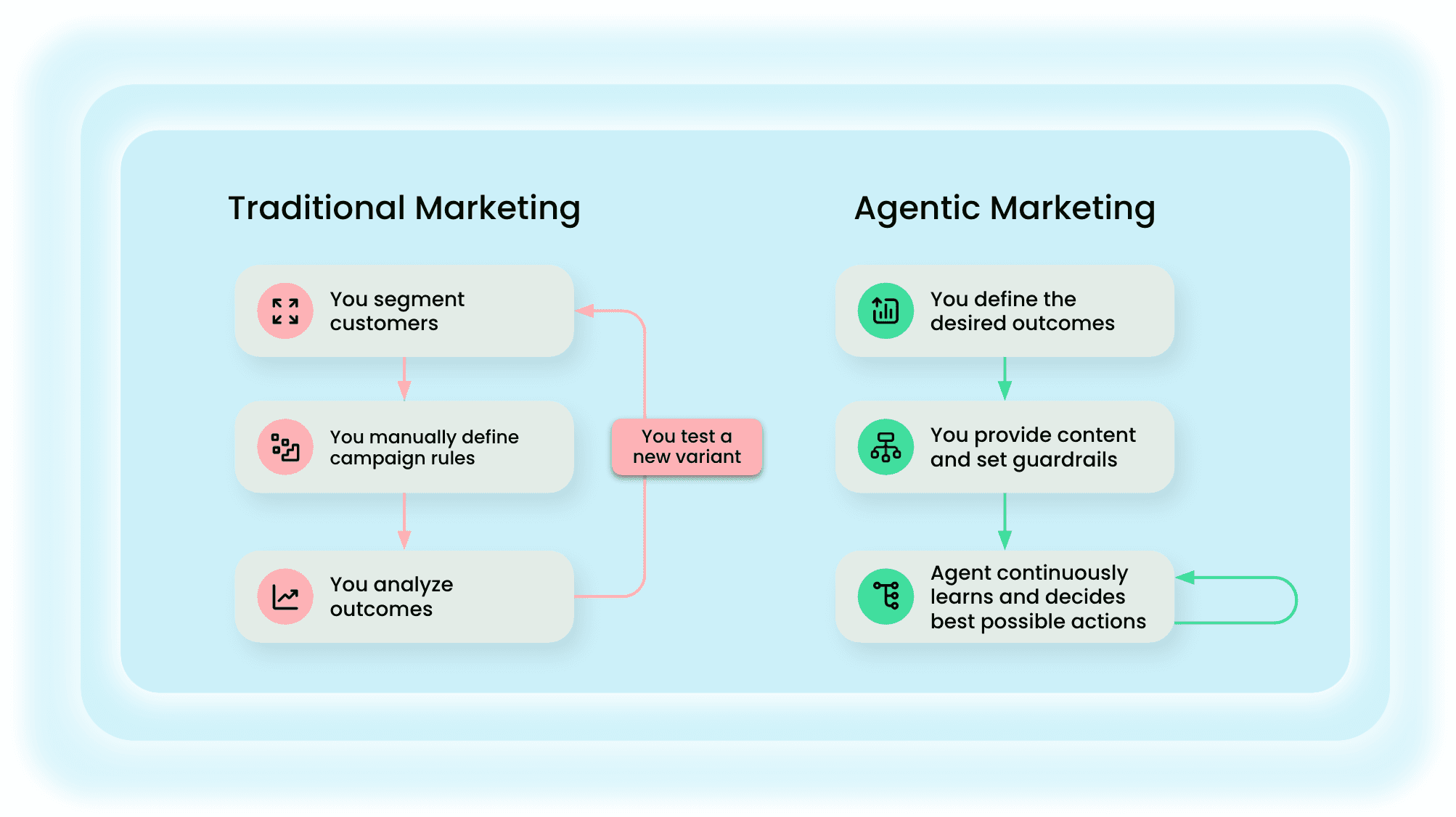

For years, marketers have relied on rule-based campaigns to engage customers—onboarding flows, product milestone triggers, cross-sell nurtures, winback sequences, and more. These tactics can drive incremental lift, but they all share the same flawed assumption: that financial behavior is predictable, linear, and consistent.

Audiences are made up of individuals with individual needs & preferences

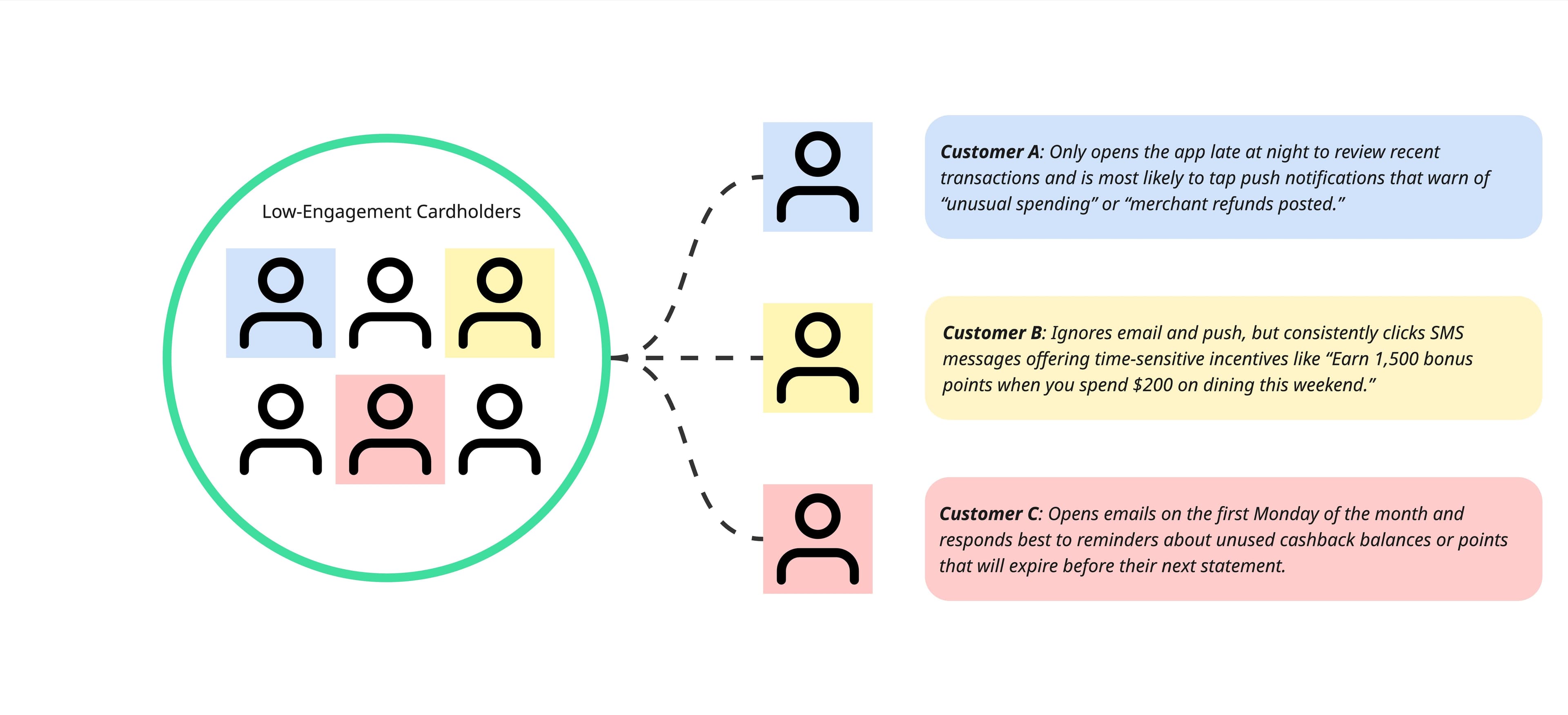

While most marketing platforms and systems can automate some key moments, the reality is that no two users are the same. A credit card application doesn’t guarantee activation, a drop in app logins doesn’t always indicate churn, and a mortgage application doesn’t mean the user is ready to buy.

At some point, no matter how much logic you build into your journeys and triggers or how granularly you segment your users, you inevitably reach a personalization ceiling where more complexity, content, offers, and creative no longer drive outcomes, and ROI begins to flatten.

It’s not that marketing teams don’t want to or can’t deliver personalized experiences; it’s that the traditional marketing systems and humans alone simply can’t process millions of decisions. That’s where AI Decisioning comes in.

Rewriting the Lifecycle Marketing Playbook with AI Decisioning

Discover how industry leaders are using AI to drive smarter, faster, and more profitable customer engagement.

Scaling 1:1 personalization with AI Decisioning

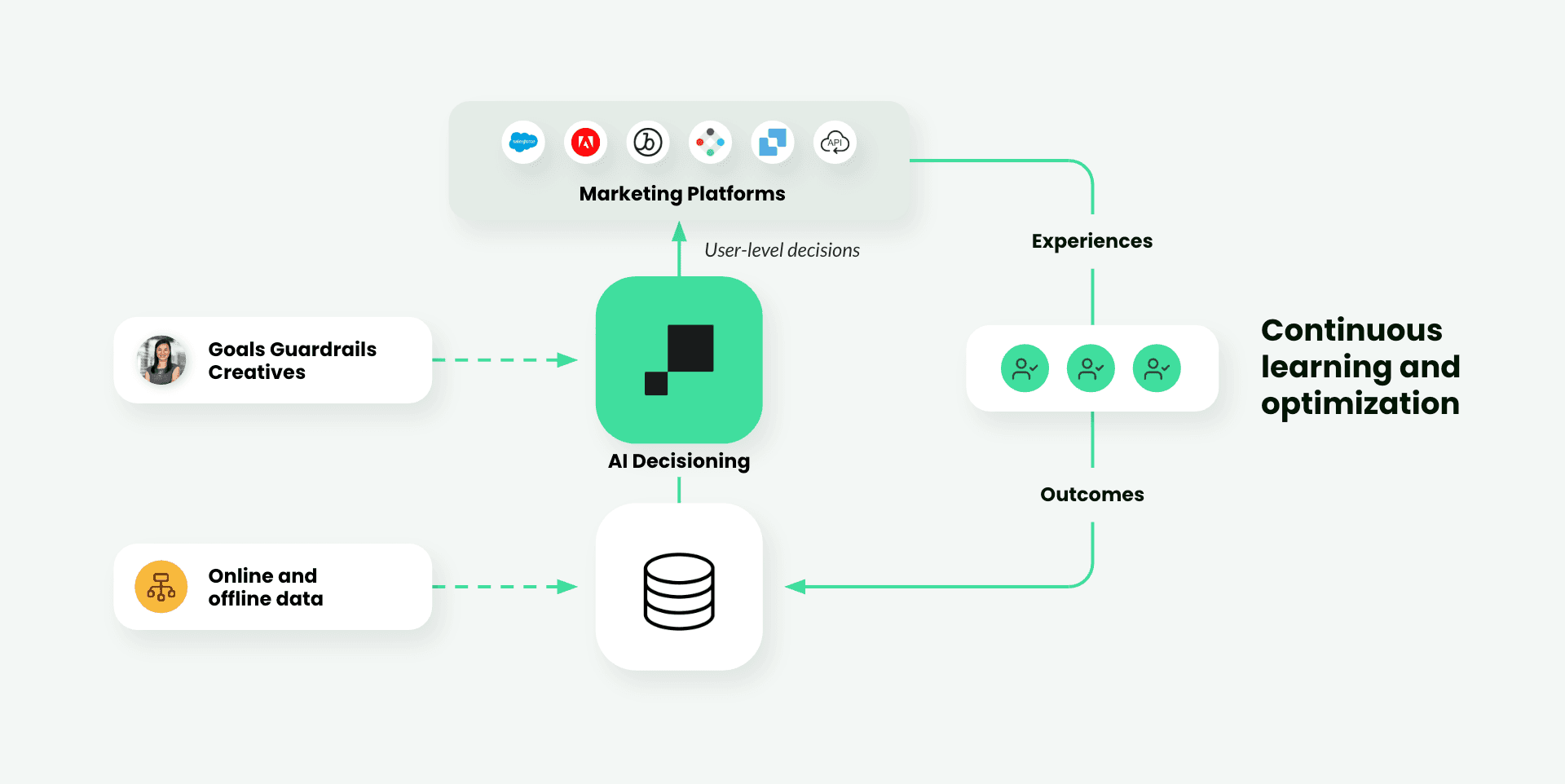

AI Decisioning platforms introduce a completely new approach to lifecycle marketing in fintech. Instead of trying to connect with people based on triggers, journeys, or segments, marketers leverage AI agents to tailor experiences to each individual.

What does that look like in practice? It starts with a goal. Simply configure AI agents with clear objectives: drive product usage, grow account funding, reduce churn, and more. Marketers still control the guardrails, like messaging, variants, offer logic, eligibility, and more, to ensure the agent operates within regulations and important parameters.

From there, the AI agents make millions of personalized decisions across the customer base, selecting the right financial product, message, channel, timing, and frequency for each individual. Behind the scenes, these agents are constantly learning and improving, via reinforcement learning and contextual bandits—and ultimately optimizing for the outcomes that matter most in fintech.

AI Decisioning unlocks outcome-based marketing

These agents go beyond human scale to respond to scenarios that would be nearly impossible to do otherwise, like:

- A customer activated their card but hasn’t made a first purchase. Should we reinforce benefits, highlight real-world use cases, or hold back to avoid pressure?

- A user paused their recurring deposit after two months. Do we re-engage immediately or wait based on patterns from similar users?

- A new savings account remains unfunded. Should we educate, incentivize, or suppress?

- Someone is browsing loan products but hasn’t applied. Are they researching or trying to buy?

AI agents make the right decision at every step of the customer experience

Thriving in the complexity of Fintech

AI Decisioning is a perfect fit for fintech, where marketing teams operate with clear goals, high volume, and significant variation across customers, products, offers, content, and channels. This complexity creates the ideal environment for AI to drive meaningful outcomes.

Take a typical bank: it may offer checking, credit, savings, lending, and investing products—each with its own eligibility rules, onboarding flows, lifecycle timelines, and behavioral drop-off points. Every customer is different, shaped by factors like payday cycles, credit scores, income volatility, and financial goals. Add in five major marketing channels (email, push, SMS, in-app, on-site), and the number of decisions becomes unmanageable—especially when timing and compliance are critical.

AI Decisioning bridges this gap by plugging directly into your infrastructure and bringing the power of AI agents to your existing marketing stack. It learns from your existing data and works seamlessly with your current martech tools. This is especially important in fintech, where data privacy and security are paramount. Because AI Decisioning doesn’t store any customer data, it minimizes risk. And since it connects to what tools you already use, implementation is fast and secure—allowing you to experiment safely and scale quickly without re-platforming or overhauling your tools.

AI Decisioning plugs right into your existing tech stack

Use cases: How AI Decisioning is transforming fintech lifecycle teams

Here are a few examples of how AI Decisioning is transforming some of the most critical use cases in financial services.

Product usage & engagement

For financial institutions, sustained product usage signals trust, satisfaction, and future revenue. But most customers never make it past initial activation, leaving cards unused, skipping savings contributions, or abandoning investment products after a single deposit.

AI Decisioning agents help users build habits around the financial tools most aligned with their needs and goals, delivering personalized nudges that strengthen behavior.

Example: A user deposited $1,000 but hasn’t contributed again in over a month. After their next app open, the agent sends a push with content that worked for similar users.

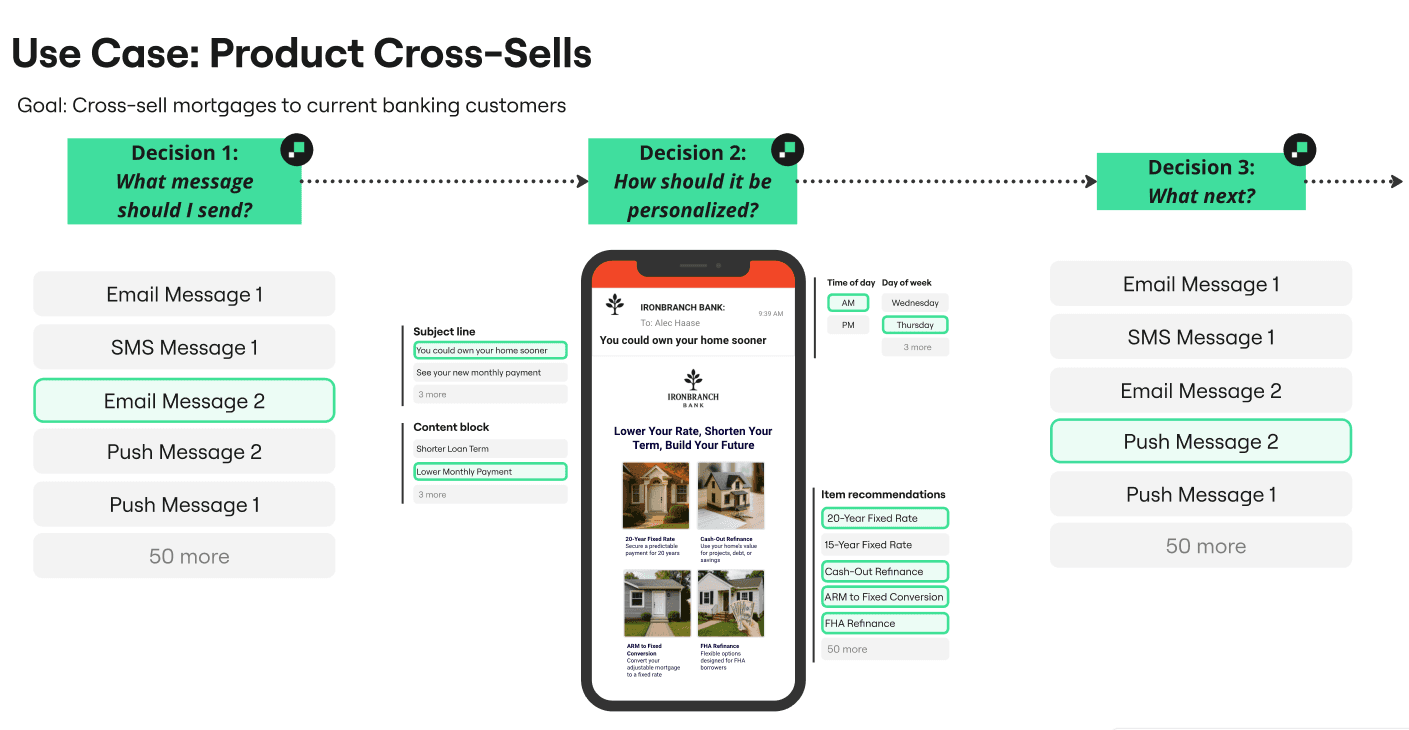

Cross-sell / upsell

Multi-product adoption is a key driver of retention and long-term value in financial services. However, prompting the next product too early or in the wrong way can feel pushy and erode trust. Lifecycle teams need smarter ways to recommend relevant products without compromising user confidence.

AI Decisioning determines the right moment, message, and product to recommend by analyzing user behavior and the outcomes of similar journeys, framing each cross-sell as helpful guidance, rather than a sales pitch.

Example :A customer who pays off their card monthly and browsed homebuyer content gets an email offering a free first-time homebuyer planning session, since similar users prefer education over rate offers.

Winback & re-engagement

Customer inactivity in financial services often reflects deeper issues like shifts in priorities, lack of perceived value, or a breakdown in trust. Unlike other industries, re-engagement must go beyond grabbing attention to restore relevance and help users realign with their financial goals.

AI Decisioning agents recognize indicators of potential churn and assess what method of re-engagement is appropriate. They analyze past behavior like login patterns, response habits, and user attributes, comparing against broader learnings from similar users, and then act.

Example: A customer abandons a mortgage application. That evening, the agent sends an email offering advisor support because similar users have converted when help is offered quickly.

Leading brands are already making the shift

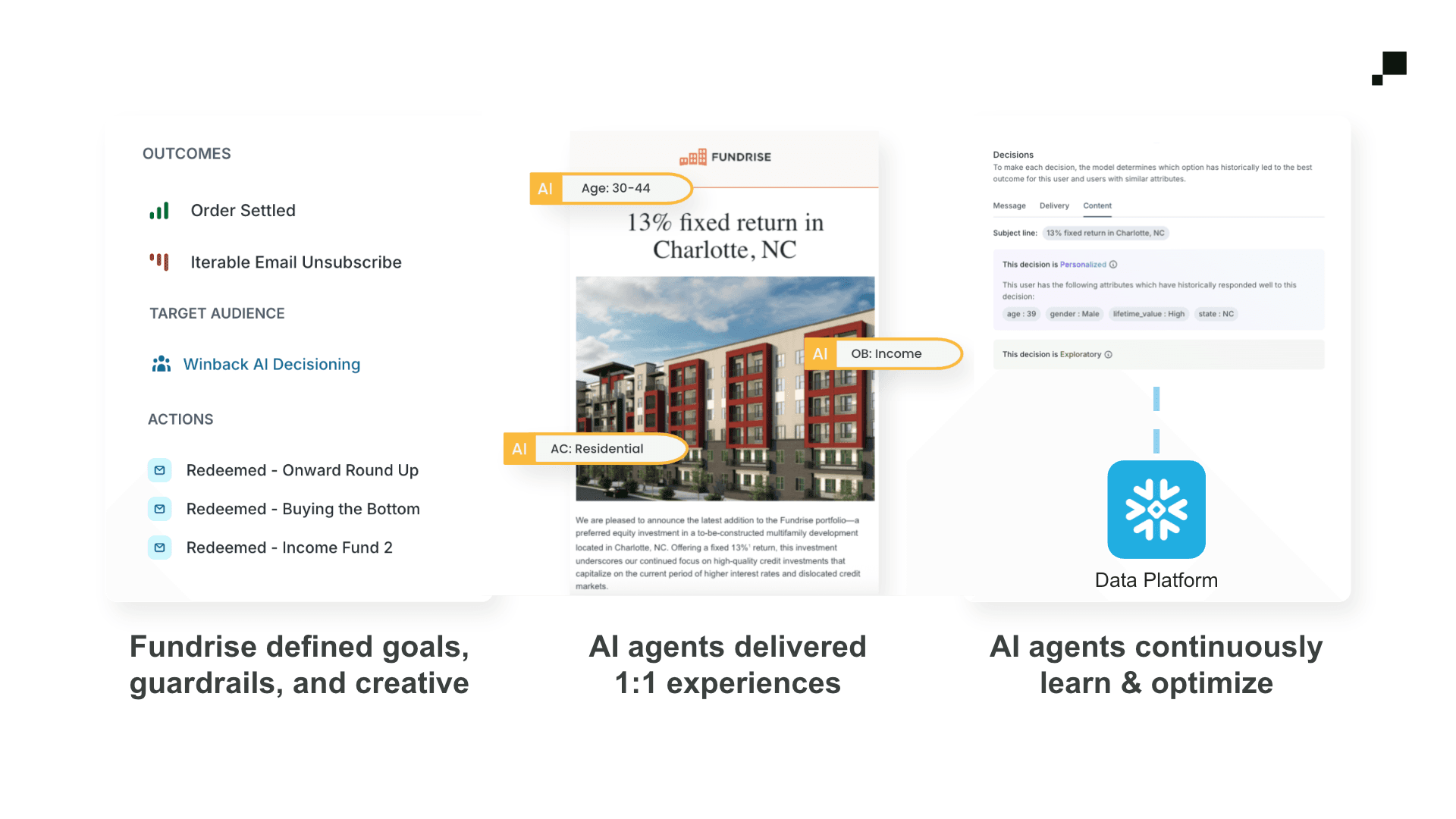

The shift to agentic marketing is already well underway in fintech. Fundrise, a leading real estate and investment platform that oversees billions in assets, saw a 4x increase in investments compared to previous campaigns within just 2-3 months of launching AI Decisioning.

Since implementing this new technology, the team has been able to completely rethink their lifecycle program and shift to an outcome-based approach. These agents aren’t just driving outcomes for the Fundrise team though; they’re also uncovering unique insights and significant correlations to create self-optimizing learning loops the marketing team can use to fuel future campaign decisions around messaging and creative.

“The beauty of AI Decisioning is that it doesn’t just change how marketing teams operate, it changes how the entire business operates. We’re learning faster and scaling faster than ever before and delivering personalized experiences that just aren’t possible with traditional marketing approaches.”

Jon Carden

Chief Marketing Officer at Fundrise

Closing thoughts

Fintech marketers don’t need more data, journeys, triggers, or campaigns. They need a system that can make smarter decisions at scale in real-time and one that adapts to each user's financial journey and improves with every send.

AI Decisioning is helping marketing teams break through this personalization ceiling to deliver 1:1 personalized experiences at scale across any marketing channel. This allows them to learn faster and drive outcomes that actually move the needle.

The stakes are incredibly high in fintech, and security is everything, so if you’re ready to move beyond the limits of traditional marketing and unlock what’s possible with AI Decisioning, grab some time with our team today!