The ultimate guide to CDPs for financial services

Learn everything there is to know about CDPs in financial services, including global trends, key insights, use cases, how leading financial services companies are leveraging personalization, and a framework for evaluating CDP vendors.

Why are financial services companies adopting CDPs?

In financial services, trust is everything. Customers have more options than ever for banking, insurance, and investments. With 80% of revenue coming from just 20% of customers,1 customer loyalty is everything. Data is your only advantage to stand out in a sea of virtually endless options.

Industry leaders in financial services differentiate themselves with personalization

Wells Fargo analyzes billions of digital interactions to power personalized conversations for 70 million customers

Chime uses Hightouch to optimize acquisition costs and audience targeting across paid media

M1 Finance’s marketing team builds audience segments using over 750 attributes

financial services use cases

Acquisition campaigns

Drive new customer acquisition using demographic and transaction data to target potential customers and untapped lookalike audiences with promotions like no-fee accounts or higher APY savings, increasing new account sign-ups.

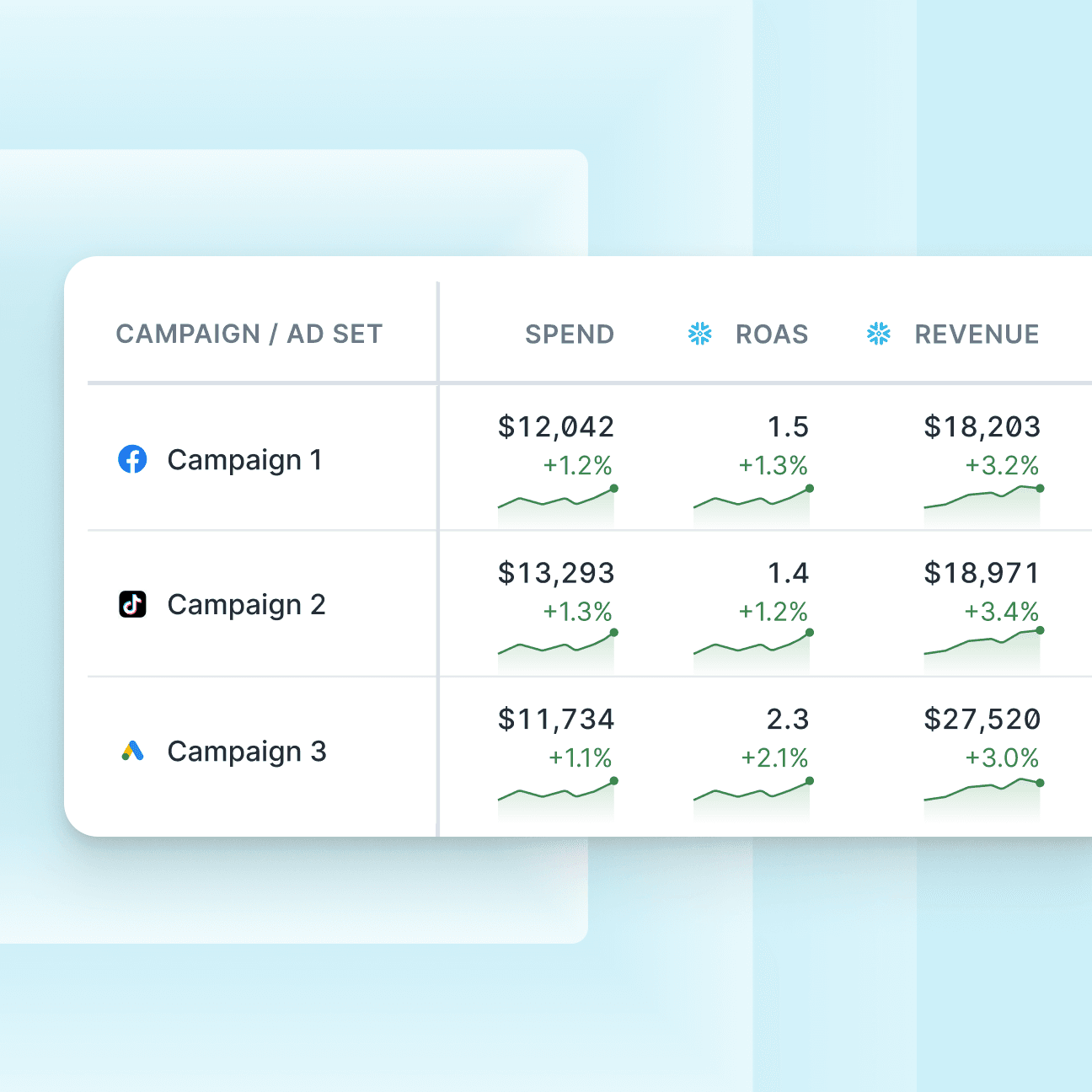

Suppression campaigns

Reduce wasted ad spend by using CRM data to suppress active account holders from acquisition campaigns and reallocate budget toward new prospects, improving ROAS and campaign efficiency.

Retargeting campaigns

Re-engage users who started but did not complete an application by retargeting them with incentives like fee waivers or account-opening bonuses to recover lost prospects and drive incremental account openings.

Cross-sell campaigns

Promote complementary financial products to existing customers by using credit card spend data to serve personalized loan offers, increasing wallet share and fulfilling unmet financial needs.

Referral campaigns

Leverage existing customers to attract new users by offering referral promotions that provide incentives for both the referrer and the new customer, driving cost-effective acquisition and advocacy.

Prequalification campaigns

Highlight prequalified financial offers by serving personalized ads featuring credit card or mortgage rates to eligible customers, increasing application conversion rates.

Education campaigns

Build trust by offering free educational resources such as financial literacy webinars to attract high-value leads, strengthening brand loyalty and acquiring informed customers.

Conversion APIs

Share online and offline conversion data with ad platforms, enabling algorithms to better identify and target users with a higher likelihood of converting to improve campaign performance.

Finance media networks

Monetize customer insights and first-party data by offering anonymized audience segments to financial brand partners for targeted advertising, generating incremental revenue through premium audience data sales.

Upsell & cross-sell campaigns

Promote complementary financial products by using transaction data to recommend relevant services like retirement accounts or investment plans, increasing LTV.

Onboarding campaigns

Encourage the completion of the initial account setup, often with incentives like waived fees or interest boosts to motivate the first use or engagement.

Account reactivation campaigns

Send personalized messages reminding users to complete their account setup, creating urgency and increasing re-engagement.

Savings challenge campaigns

Encourage recurring deposits with gamified incentives and rewards, promoting long-term financial habits.

Rate change notifications

Notify customers of favorable rate changes, like loan rate decreases or higher savings interest rates, prompting action.

Localized promotions

Highlight region-specific financial services, such as mortgage offers in high-demand housing markets, increasing local engagement.

Fee reduction campaigns

Offer limited-time fee waivers to reward frequent users, boosting customer goodwill and retention.

Loyalty program engagement

Encourage higher spending and credit card usage by offering tiered rewards, bonus points, or exclusive perks.

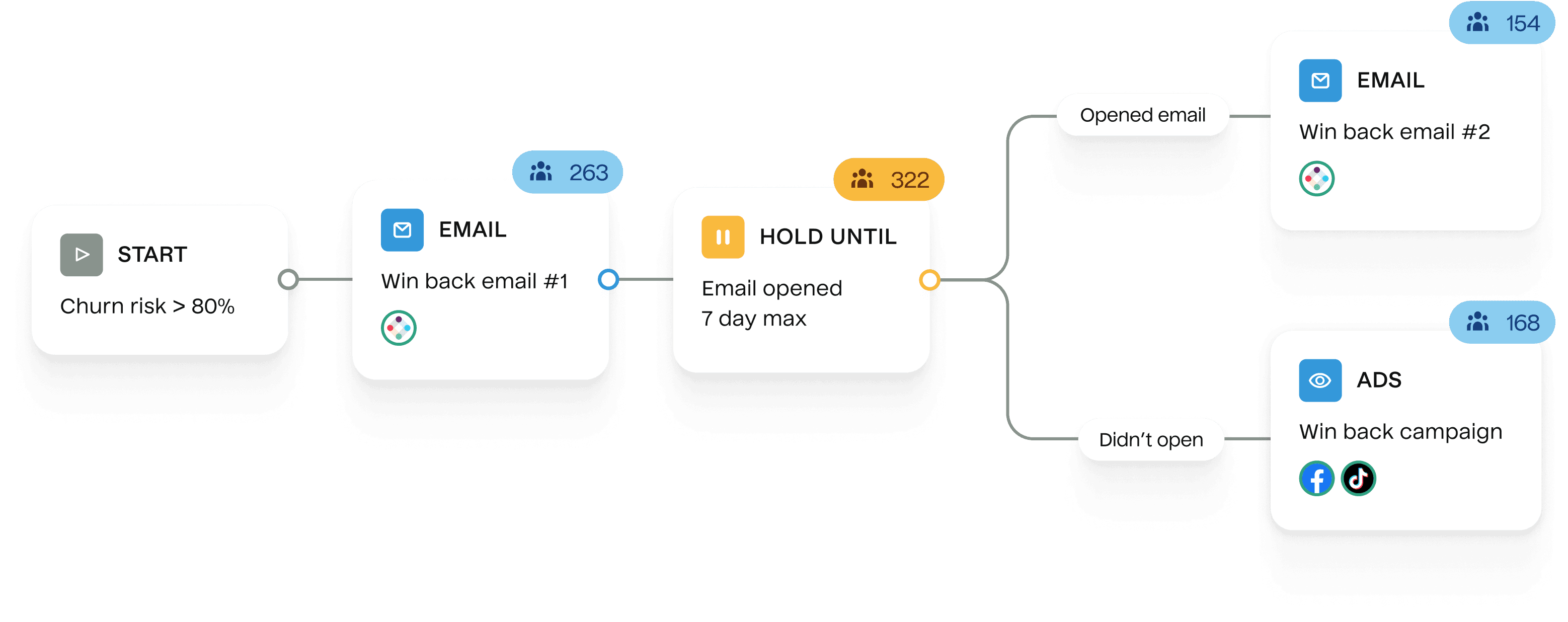

Churn prevention campaigns

Reduce churn by sending proactive support, reminders, or special incentives to at-risk customers.

Dynamic home page content

Display personalized financial dashboards showcasing savings progress, spending trends, and relevant product suggestions to improve user engagement and drive financial decisions.

Dynamic app experiences

Customize app navigation by prioritizing frequently used features such as bill payments, loan calculators, or rewards tracking to enhance user satisfaction and retention.

Dynamic search results

Adjust search rankings to highlight the most relevant financial products based on user behavior, such as displaying low-interest credit cards to those exploring loan options.

Recommended products

Suggest financial products like CDs, investment accounts, or credit card upgrades based on user behavior and financial goals to increase product adoption.

Next best action

Guide users toward high-value financial actions such as setting up auto-savings, upgrading accounts, or consolidating debt to improve financial outcomes and service utilization.

Proactive bill reminders

Reduce late payments by displaying reminders for upcoming or recently missed bills via dashboards and notifications, helping users avoid fees and build trust.

Savings goal tracking

Encourage financial progress by tracking deposits and spending habits, suggesting goal timelines, and rewarding milestones with badges or incentives to boost recurring deposits.

Personalized rewards tracking

Promote loyalty program participation by highlighting available rewards and suggesting actions to maximize points, such as reaching spending thresholds for travel vouchers or cashback bonuses.

Pre-qualified offers

Dynamically display personalized pre-approved credit card, loan, or mortgage offers within user dashboards to increase conversions and reduce application friction.

What financial services companies should consider when evaluating a CDP

90%5 of marketers say their traditional CDP does not do what they need, so why do they keep buying them?

| Category | Traditional CDP | Composable CDP |

|---|---|---|

| Architecture | Operates as a separate entity, removed from your company’s data | Integrates directly within your company’s data infrastructure |

| Security & data storage | Data is stored and maintained in the CDP’s data infrastructure | Data is stored and maintained in your existing data infrastructure |

| Data access | Supports user and event data | Supports both online and offline data |

| Data modeling | Uses predefined models that may not fully capture complex account hierarchies or transactional categories | Supports tailored models for account hierarchies, transaction histories, and credit product relationships |

| Audience management | Supports broad segmentation but struggles with categories like customer tiers, account types, or credit scores | Enables granular segmentation using financial attributes like transaction behaviors risk scores or account balances |

| Customer journey customization | Provides standard templates for campaigns like onboarding or email promotions | Powers fully adaptable journeys for financial events like loan approvals, credit upgrades, and savings goal milestones |

| Identity resolution | Relies on out-of-the-box algorithms that may not unify profiles across credit services and banking platforms | Supports custom algorithms to unify customer profiles across accounts, credit services, and digital banking |

| Pricing | Bundled pricing: dependent on monthly tracked users (MTUs) & feature add-ons | Unbundled: individually priced features with no MTU billing |

| Average implementation time | 6-12 months | 1-4 months |

- ArchitectureIntegrates directly within your company’s data infrastructure

- Security & data storageData is stored and maintained in your existing data infrastructure

- Data accessSupports both online and offline data

- Data modelingSupports tailored models for account hierarchies, transaction histories, and credit product relationships

- Audience managementEnables granular segmentation using financial attributes like transaction behaviors risk scores or account balances

- Customer journey customizationPowers fully adaptable journeys for financial events like loan approvals, credit upgrades, and savings goal milestones

- Identity resolutionSupports custom algorithms to unify customer profiles across accounts, credit services, and digital banking

- PricingUnbundled: individually priced features with no MTU billing

- Average implementation time1-4 months

- ArchitectureOperates as a separate entity, removed from your company’s data

- Security & data storageData is stored and maintained in the CDP’s data infrastructure

- Data accessSupports user and event data

- Data modelingUses predefined models that may not fully capture complex account hierarchies or transactional categories

- Audience managementSupports broad segmentation but struggles with categories like customer tiers, account types, or credit scores

- Customer journey customizationProvides standard templates for campaigns like onboarding or email promotions

- Identity resolutionRelies on out-of-the-box algorithms that may not unify profiles across credit services and banking platforms

- PricingBundled pricing: dependent on monthly tracked users (MTUs) & feature add-ons

- Average implementation time6-12 months

Why Hightouch for financial services?

Your CDP vendor should mold to your data — not the other way around. Hightouch is purpose-built to handle the complexity of financial services.

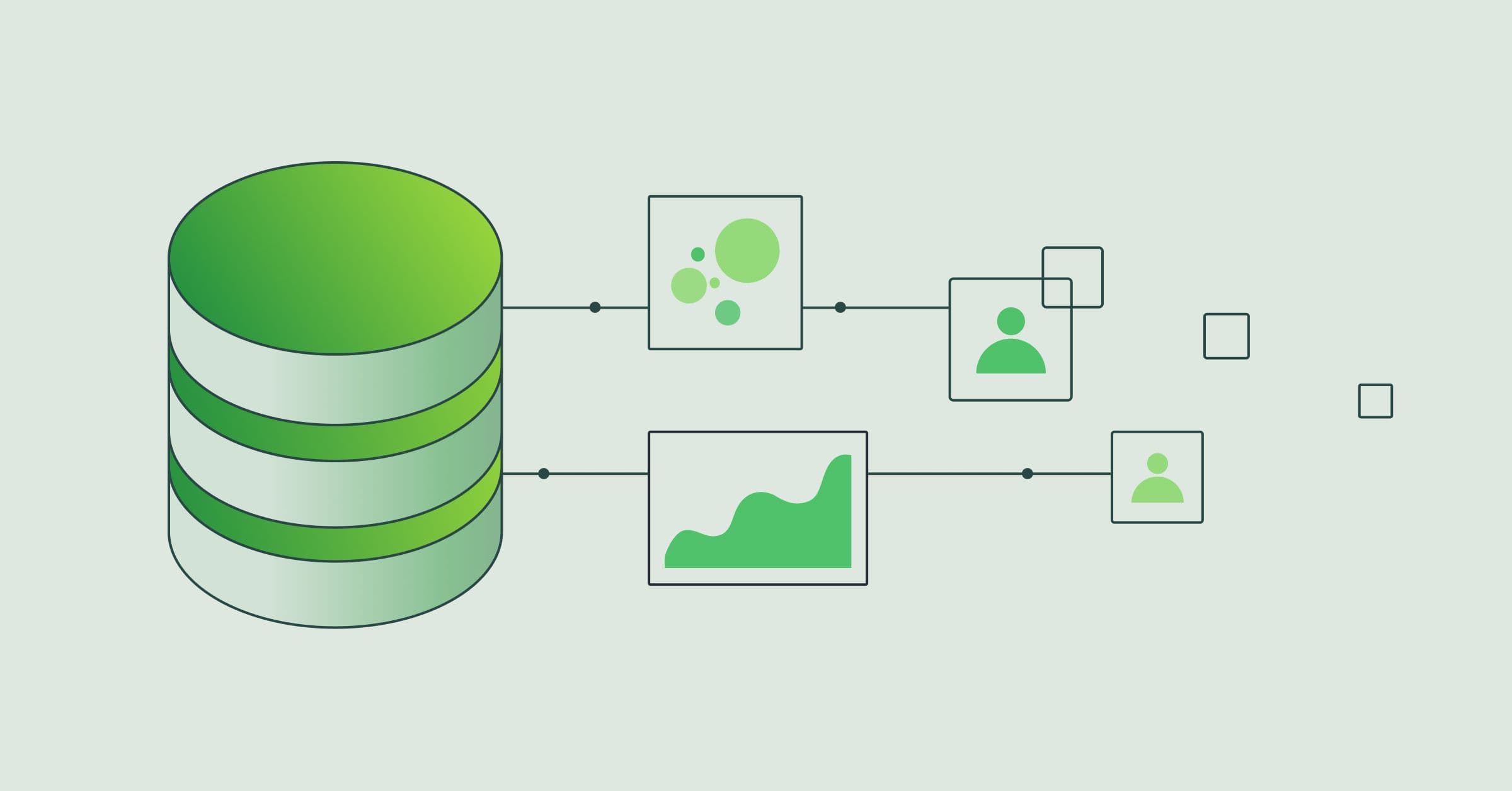

Leverage any data point in your warehouse – not just users, accounts, and events.

Build and activate audiences directly from your warehouse.

Integrate with your existing data infrastructure on your warehouse.

Leverage any data point in your warehouse – not just users, accounts, and events.

A complete CDP for financial services

Members

Overlap

Prospective borrowers with incomplete applications

2,988 members

1,974 members

Abandoned loan applications 2,988

Pre-approved credit card recipients 1,974

Member overlap 378 or 12.65%

Customer Data Platform resources

Explore Customer Data Platforms by industry

Discover why leaders across all industries and adopting CDPs and how they are taking action on their customer data to drive engagement and revenue.

Connect to 250+ tools

Send any data to any tool. Skip building and maintaining pipelines, uploading CSVs, and having data silos across marketing, sales, customer success, finance, and analytics.